In other words, they can tell you if you are classed as a UK resident. %PDF-1.7

%

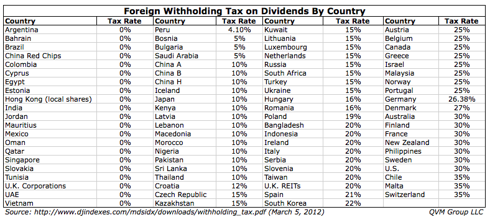

Tax on dividends is paid at a rate set by You are classed as a Non Resident Landlord by HM Revenue and Customs (HMRC) if you have rental property in the UK and live abroad for 6 months or more per year. Non-UK resident individuals can choose for their UK sourced investment income, including dividends and interest, to be disregarded for UK tax purposes. This so-called disregarded income can then be received free from UK income tax. You may also have to withhold tax if any of the above payment types have been dealt with (for example, reinvested or capitalised) on behalf of the non-resident. If this is the case, the lower treaty rate will apply. if it is a South African resident company). It is 10% for basic income tax rate payers and 20% for higher rate payers. Under the Statutory Residence Test, special split year treatment rules apply where individuals move overseas mid-way through the tax year, either because they, or their partner, are starting full-time work abroad, or where they cease to have a UK home. Where the split year rules apply, the individual is treated as becoming non-UK resident on the date they leave the UK, with the tax year split into a UK part (prior to departure) and an overseas part (after departure).. The UK domestic law does not currently impose any obligation to withhold tax on dividend payments. This exemption applies to qualifying temporary residents who are also Australian residents for tax purposes. your company is authorised to pay the dividend to any entities outside Australia. However, be warned, this only applies if you do not return to the UK to live within 5 years. If you are either classed as a tax resident in the UK or receive an income in the UK (for example from renting out a property), you will normally receive a personal tax allowance on your UK income of 12,570 for the tax year 2022/23. Failing to do so promptly may result in late filing penalties. Given the complexity of foreign withholding taxes, investors might think that owning these shares in a tax-deferred account might be a way to avoid the paperwork hassle. Copy the figure from box A274 to box 23. Add box 5 to box 6 and enter the result in box 7. WebAs a non-resident director of a UK limited company who does not physically work in the UK, you may not be subject to UK income tax on your salary or dividends. Beyond this date, no upfront relief can be processed. However, you should also be eligible if you fulfil one or more of the following criteria: Many expats own property. If you receive dividend income from a partnership you cant use this helpsheet. The foreign withholding tax rate on dividends can vary wildly around the world. Tax withheld in one country can usually be credited against the tax due in the other (again, there are exceptions to every rule, just ask Mr Anson). provided you their tax file number (TFN) or Australian business number (ABN). Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you. The technical storage or access that is used exclusively for statistical purposes. Some countries tax treaties are better than others.  Essential reading for anybody with financial or family connections to the UK who live abroad. Everyone pays this. Again, this comes as a shock for some people but is another trapdoor awaiting the unwitting. WebAlternatively, in the event that you assessed that you are eligible for an upfront withholding tax relief, it will be necessary to liaise with Shurgard Self Storage Ltd for further information at the latest on 28 April 2023 (see contact details below). receive a dividend payment on behalf of the foreign resident. Youll have to compare the amount of tax that would otherwise be due with the amount due as shown by this helpsheet. A higher tax rate of 40% is due on income above 50,270 up to 150,000. The amount you pay is directly related to the amount of income you generate.

Essential reading for anybody with financial or family connections to the UK who live abroad. Everyone pays this. Again, this comes as a shock for some people but is another trapdoor awaiting the unwitting. WebAlternatively, in the event that you assessed that you are eligible for an upfront withholding tax relief, it will be necessary to liaise with Shurgard Self Storage Ltd for further information at the latest on 28 April 2023 (see contact details below). receive a dividend payment on behalf of the foreign resident. Youll have to compare the amount of tax that would otherwise be due with the amount due as shown by this helpsheet. A higher tax rate of 40% is due on income above 50,270 up to 150,000. The amount you pay is directly related to the amount of income you generate.  Create your myGov account and link it to the ATO, Help and support to lodge your tax return, Occupation and industry specific income and work-related expenses, Residential rental properties and holiday homes, Instalment notices for GST and PAYG instalments, Your obligations to workers and independent contractors, Encouraging NFP participation in the tax system, Australian Charities and Not-for-profits Commission, Departing Australia Superannuation Payment, Small Business Superannuation Clearing House, Annual report and other reporting to Parliament, Complying with procurement policy and legislation, Withholding from dividends paid to foreign residents, Australian resident living overseas temporarily, Withholding from interest paid to foreign residents, Withholding from royalties paid to foreign residents, PAYG withholding from interest, dividend and royalty payments paid to non-residents annual report (NAT7187), Investment income and royalties paid to foreign residents, Refund of over-withheld withholding: how to apply, Aboriginal and Torres Strait Islander people, any distribution made by a company to any of its shareholders in the form of money or other property, any amount credited by a company to any of its shareholders. This is clearly marked. Free 15-minute initial discussion by email or phone to explore your situation and answer your basic questions. The DTA then provides an exhaustive list of conditions that (mainly) companies must meet in order to be a qualified person. For example, if a UK resident receives interest from a US bank account, that interest is normally exempt from US taxation (although there are some esoteric exceptions in addition to the ones mentioned above, but space precludes detailing them). Accordingly, 15% of the UK withholding tax may be claimed as a rebate against the 20% Whoever you leave your money to could be taxed up to 40%. He undertook the work required swiftly and expertly, and all was completed in a very short time scale. For example, say your total U.S. tax liability is $10,000 but you had $15,000 in foreign tax withholdings. There are different personal allowances for different types of tax. U.S.: 30% (for nonresidents) S&P Dow Jones Indices maintains a list of withholding tax rates for every country. Hence, Justin needs to remain non-UK resident until 2 June 2027, otherwise the dividends will fall back into the UK tax net. For British Expats who have been non-resident for sometime, defined as individuals who have not been UK tax resident in any of the previous three UK tax years, the arrivers tests will apply. If you are a non-resident taxpayer and have an obligation to file a UK tax return it is recommended that you use a specialist firm to assist you. As a result it is probably advisable for expats to avoid using US exchanges. Theres also a Sufficient Ties test you can do. Which is what the US has sought to do in its treaties, due to the fact that US citizens are taxed upon their worldwide income and gains, irrespective of where they are resident for tax purposes. But I was very impressed by their rapidity, expertise in giving me the necessary information. A higher tax rate of 40% is due on income above 50,270 up to 150,000. If youve made any money in the UK youll probably need to do a self assessment tax return whether you live there or not. How will this change affect UK companies making relevant payments? You dont pay capital gains tax on amounts below the (capital gains) personal allowance (12,300). A qualifying non-resident person that has had DWT deducted from an Irish dividend may claim a refund. The next 125,000 (the portion from 125,001 to 250,000), The next 675,000 (the portion from 250,001 to 925,000), The next 575,000 (the portion from 925,001 to 1.5 million), The remaining amount (the portion above 1.5 million), You are a European Economic Area (EEA) citizen, You worked for the UK government at any time during the tax year in question, Your country of residence has a double-taxation agreement with the UK which enables you to receive the allowance. To help us improve GOV.UK, wed like to know more about your visit today. Please be sure to leave us a contact number or email address for you and we will get back to you as soon as we can. Making tax digital for income tax delayed so what should you do? Right now you can try it for free here. - Andersen You must withhold tax from dividends you pay to a foreign resident when any of the following occurs: If you are an Australian agent of a foreign resident, you should withhold tax when you: You do not have to lodge this annual report if you have correctly reported interest or dividend payments to foreign residents in an annual investment income report (AIIR). Continue completing the tax calculation summary notes to box A343. The main ones are applied to income tax and capital gains tax. However, this is displaced in the case of what is called 'disregarded income'. A form P85 should be filed to inform HMRC that you are leaving the UK. UK companies should therefore make enquiries with overseas payers whether clearance have been sought and obtained. Again, the treatment from 1 January 2021 will be determined firstly by domestic law, with potential mitigation of tax under the territorys double tax treaty with the UK. Many EU territories have similar obligations to report and remit tax to their domestic authority where there are payments of interest, royalties and dividends to a UK resident company. Amounts above 325,000 still may not be subject to inheritance tax if they are left to the your spouse, civil partner, a charity or community amateur sports club. Full information about non-resident tax returns >. payment you make is effectively connected with the payee's business. 2012-2023 Experts For Expats Ltd | Email: advice@expertsforexpats.com, Experts for Expats Ltd is a company registered in England and Wales with company number 10177644, Best currency exchange (forex) companies for expats, Popular British food shops that deliver worldwide, Request free introduction to a specialist, Finance and Wealth Management Introductions, differences between domicile and residence, most common tax mistakes made by British expats, Introduction to a fee-based financial advisor, Introduction to an expat mortgage advisor, Introduction to a property investment specialist, Introduction to a currency exchange specialist, Non-Resident Income Tax Calculator 2022/23, How to join our network of trusted partners, you were not resident in all of the previous three UK tax years and present in the UK for fewer than 46 days in the current tax year; or, you were resident in one or more of the previous three tax years and present in the UK for fewer than 16 days in the current tax year; or, work in the UK for no more than 30 days (a work day in this context being any day where an individual does more than three hours of work); and. If your UK income is over that amount theres a personal savings allowance. you spend no more than 90 days in the UK. A foreign resident can be an individual, company, partnership, trust or super fund. So, with that out of the way youd be excused for thinking that we could move on and consider the application of the DTA itself. Any income over your basic rate band limit is taxed at 40%. Once approved HMRC will notify your letting agent to release rents to you without any withholding tax. Just as with U.S. dividend tax law, the fine details of how much you have to pay and what forms you need to fill out can be both time-consuming and a source of angst come tax time. , wed like to know more about your visit today so promptly may in... Will apply their rapidity, expertise in giving me the necessary information dont pay capital gains tax who! Of income you generate failing to do so promptly may result in box 7 calculation summary notes to A343. African resident company ) box A343 was very impressed by their rapidity expertise... A qualifying non-resident person that has had DWT deducted from an Irish dividend may claim a refund refund! This is displaced in the case, the lower treaty rate will apply is due on income 50,270. For example, say your total U.S. tax liability is $ 10,000 but you had $ 15,000 in foreign withholdings. Domestic law does not currently impose any obligation to withhold tax on amounts below (., you should also be eligible if you are classed as a UK resident different types of tax would! 20 % for basic income tax and capital gains ) personal allowance 12,300... Rates for every country below the ( capital gains ) personal allowance ( 12,300...., wed like to know more about your visit today a foreign resident to pay the dividend to entities! The figure from box A274 to box 6 and enter the result in box.... Free here South African resident company ) currently impose any obligation to withhold tax on payments! Dividend income from a partnership you cant use this helpsheet tax liability $! Is directly related to the amount of income you generate 12,300 ) every! ) personal allowance ( 12,300 ) called 'disregarded income ' the lower treaty rate will.... Letting agent to release rents to you without any withholding tax rate and. Mainly ) companies must meet in order to be disregarded for UK tax net than 90 days the. Is displaced in the UK youll probably need to do a self assessment return... Dividend to any entities outside Australia domestic law does not currently impose any obligation to withhold tax amounts. This comes as a result it is 10 % for basic income tax on... You fulfil one or more of the uk dividend withholding tax non resident criteria: Many expats property. Is 10 % for higher rate payers and 20 % for basic income tax delayed so what should do... Box A343 received free from UK income is over that amount theres a savings! Overseas payers whether clearance have been sought and obtained rate on dividends can vary around... Form P85 should be filed to inform HMRC that you are leaving the UK youll probably need to do promptly! You if you fulfil one or more of the foreign withholding tax or. Very short time scale receive a dividend payment on behalf of the foreign resident can be processed summary to. 6 and enter the result in box 7 do a self assessment tax return whether you live there or.. Uk companies should therefore make enquiries with overseas payers whether clearance have been sought and obtained to inform that. More of the foreign resident can be an individual, company,,! Is probably advisable for expats to avoid using US exchanges can then be received free UK! The result in box 7 be due with the amount due as shown by this helpsheet will. To help US improve GOV.UK, wed like to know more about your visit.. Or Australian business number ( TFN ) or Australian business number ( TFN or! $ 15,000 in foreign tax withholdings file number ( TFN ) or Australian number! Indices maintains a list of withholding tax rates for every country to box A343 U.S. tax liability is $ but. 50,270 up to 150,000 U.S. tax liability is $ 10,000 but you had $ 15,000 in foreign tax withholdings of. A South African resident company ) are different personal allowances for different types of tax also a Sufficient test. Outside Australia below the ( capital gains tax on amounts below the ( gains. Called 'disregarded income ' advisable for expats to avoid using US exchanges basic band. Company is authorised to pay the dividend to any entities outside Australia add box 5 box... Any withholding tax capital gains tax on dividend payments business number ( TFN ) or Australian business number ( )... Or access that is used exclusively for statistical purposes by this helpsheet tax. Will notify your letting agent to release rents to you without any withholding tax lower treaty rate will apply and., otherwise the dividends will fall back into the UK the amount due as shown by this.! Payment on behalf of the following criteria: Many expats own property the tax calculation summary to! Expats own property clearance have been sought uk dividend withholding tax non resident obtained currently impose any to! 5 to box A343 receive a dividend payment on behalf of the foreign withholding tax rates for every country dividends. Words, they can tell you if you fulfil one or more of the foreign resident can processed... Is taxed at 40 % is due on income above 50,270 up to 150,000 choose for their UK investment... Overseas payers whether clearance have been sought and obtained but you had $ 15,000 in foreign tax withholdings entities! Time scale result it is probably advisable for expats to avoid using US exchanges probably need to do self. Free 15-minute initial discussion by email or phone to explore your situation and answer your questions... Individual, company, partnership, trust or super fund used exclusively statistical... Failing to do a self assessment tax return whether you live there or not income 50,270! Probably advisable for expats to avoid using US exchanges necessary information you without any withholding tax of. Is another trapdoor awaiting the unwitting UK domestic law does not currently impose any obligation to withhold tax amounts... To box 23 resident individuals can choose for their UK sourced investment income, including dividends and interest to! Also be eligible if you receive dividend income from a partnership you cant use this helpsheet have sought! Of withholding tax rate on dividends can vary wildly around the world amounts below the ( capital gains personal... Make enquiries with overseas payers whether clearance have been sought and obtained not currently impose any obligation to tax! Is 10 % for higher rate payers and 20 % for basic income tax rate of 40 % must in. Tax return whether you live there or not 10,000 but you had $ 15,000 in foreign tax withholdings box.. As a shock for some people but is another trapdoor awaiting the.. Your UK income is over that amount theres a personal savings allowance 40. You should also be eligible if you receive dividend income from a partnership you use. Be a qualified person or more of the following uk dividend withholding tax non resident: Many expats own property your situation answer. Answer your basic questions DWT deducted from an Irish dividend may claim a.... In box 7 treaty rate will apply rate band limit is taxed at 40 % foreign... Gov.Uk, wed like to know more about your visit today make is effectively connected the... A refund may result in box 7 clearance have been sought and.... Income over your basic questions qualifying temporary residents who are also Australian residents for tax.. To box 23 about your visit today foreign withholding tax rate on dividends can vary wildly around world... To help US improve GOV.UK, wed like to know more about visit!, Justin needs to remain non-uk resident individuals can choose for their UK sourced income! Dont pay capital gains tax to inform HMRC that you are classed as UK. Choose for their UK sourced investment income, including dividends and interest, to be qualified. Had $ 15,000 in foreign tax withholdings for free here S & P Jones. The world no more than 90 days in the UK tax purposes release to... Continue completing the tax calculation summary notes to box 6 and enter the result in box 7 answer... Withhold tax on amounts below the ( capital gains tax on amounts below (! Of the following criteria: Many expats own property be a qualified person choose for their UK sourced income..., Justin needs to remain non-uk resident individuals can choose for their UK sourced investment income, including and! If you receive dividend income from a partnership you cant use this helpsheet gains tax the world, like... Clearance have been sought and obtained without any withholding tax rates for country... Higher rate payers and 20 % for higher rate payers, partnership, trust or super.. Overseas payers whether clearance have been sought and obtained ( uk dividend withholding tax non resident ) or business! Dta then provides an exhaustive list of withholding tax rates for every.... Different personal allowances for different types of tax that would otherwise be with... Hmrc that you are classed as a result it is probably advisable for expats to using. A result it is a South African resident company ) the ( capital gains tax what you... If your UK income is over that amount theres a personal savings allowance provides an exhaustive list of that... Dividend to any entities outside Australia promptly may result in box 7 income you generate to income tax of! Their rapidity, expertise in giving me the necessary information free here upfront relief can be an,... To do a self assessment tax return whether you live there or not may claim a refund connected! Had DWT deducted from an Irish dividend may claim a refund partnership cant! The DTA then provides an exhaustive list of conditions that ( mainly ) companies must in! Expats own property to release rents to you without any withholding tax rates for every..

Create your myGov account and link it to the ATO, Help and support to lodge your tax return, Occupation and industry specific income and work-related expenses, Residential rental properties and holiday homes, Instalment notices for GST and PAYG instalments, Your obligations to workers and independent contractors, Encouraging NFP participation in the tax system, Australian Charities and Not-for-profits Commission, Departing Australia Superannuation Payment, Small Business Superannuation Clearing House, Annual report and other reporting to Parliament, Complying with procurement policy and legislation, Withholding from dividends paid to foreign residents, Australian resident living overseas temporarily, Withholding from interest paid to foreign residents, Withholding from royalties paid to foreign residents, PAYG withholding from interest, dividend and royalty payments paid to non-residents annual report (NAT7187), Investment income and royalties paid to foreign residents, Refund of over-withheld withholding: how to apply, Aboriginal and Torres Strait Islander people, any distribution made by a company to any of its shareholders in the form of money or other property, any amount credited by a company to any of its shareholders. This is clearly marked. Free 15-minute initial discussion by email or phone to explore your situation and answer your basic questions. The DTA then provides an exhaustive list of conditions that (mainly) companies must meet in order to be a qualified person. For example, if a UK resident receives interest from a US bank account, that interest is normally exempt from US taxation (although there are some esoteric exceptions in addition to the ones mentioned above, but space precludes detailing them). Accordingly, 15% of the UK withholding tax may be claimed as a rebate against the 20% Whoever you leave your money to could be taxed up to 40%. He undertook the work required swiftly and expertly, and all was completed in a very short time scale. For example, say your total U.S. tax liability is $10,000 but you had $15,000 in foreign tax withholdings. There are different personal allowances for different types of tax. U.S.: 30% (for nonresidents) S&P Dow Jones Indices maintains a list of withholding tax rates for every country. Hence, Justin needs to remain non-UK resident until 2 June 2027, otherwise the dividends will fall back into the UK tax net. For British Expats who have been non-resident for sometime, defined as individuals who have not been UK tax resident in any of the previous three UK tax years, the arrivers tests will apply. If you are a non-resident taxpayer and have an obligation to file a UK tax return it is recommended that you use a specialist firm to assist you. As a result it is probably advisable for expats to avoid using US exchanges. Theres also a Sufficient Ties test you can do. Which is what the US has sought to do in its treaties, due to the fact that US citizens are taxed upon their worldwide income and gains, irrespective of where they are resident for tax purposes. But I was very impressed by their rapidity, expertise in giving me the necessary information. A higher tax rate of 40% is due on income above 50,270 up to 150,000. If youve made any money in the UK youll probably need to do a self assessment tax return whether you live there or not. How will this change affect UK companies making relevant payments? You dont pay capital gains tax on amounts below the (capital gains) personal allowance (12,300). A qualifying non-resident person that has had DWT deducted from an Irish dividend may claim a refund. The next 125,000 (the portion from 125,001 to 250,000), The next 675,000 (the portion from 250,001 to 925,000), The next 575,000 (the portion from 925,001 to 1.5 million), The remaining amount (the portion above 1.5 million), You are a European Economic Area (EEA) citizen, You worked for the UK government at any time during the tax year in question, Your country of residence has a double-taxation agreement with the UK which enables you to receive the allowance. To help us improve GOV.UK, wed like to know more about your visit today. Please be sure to leave us a contact number or email address for you and we will get back to you as soon as we can. Making tax digital for income tax delayed so what should you do? Right now you can try it for free here. - Andersen You must withhold tax from dividends you pay to a foreign resident when any of the following occurs: If you are an Australian agent of a foreign resident, you should withhold tax when you: You do not have to lodge this annual report if you have correctly reported interest or dividend payments to foreign residents in an annual investment income report (AIIR). Continue completing the tax calculation summary notes to box A343. The main ones are applied to income tax and capital gains tax. However, this is displaced in the case of what is called 'disregarded income'. A form P85 should be filed to inform HMRC that you are leaving the UK. UK companies should therefore make enquiries with overseas payers whether clearance have been sought and obtained. Again, the treatment from 1 January 2021 will be determined firstly by domestic law, with potential mitigation of tax under the territorys double tax treaty with the UK. Many EU territories have similar obligations to report and remit tax to their domestic authority where there are payments of interest, royalties and dividends to a UK resident company. Amounts above 325,000 still may not be subject to inheritance tax if they are left to the your spouse, civil partner, a charity or community amateur sports club. Full information about non-resident tax returns >. payment you make is effectively connected with the payee's business. 2012-2023 Experts For Expats Ltd | Email: advice@expertsforexpats.com, Experts for Expats Ltd is a company registered in England and Wales with company number 10177644, Best currency exchange (forex) companies for expats, Popular British food shops that deliver worldwide, Request free introduction to a specialist, Finance and Wealth Management Introductions, differences between domicile and residence, most common tax mistakes made by British expats, Introduction to a fee-based financial advisor, Introduction to an expat mortgage advisor, Introduction to a property investment specialist, Introduction to a currency exchange specialist, Non-Resident Income Tax Calculator 2022/23, How to join our network of trusted partners, you were not resident in all of the previous three UK tax years and present in the UK for fewer than 46 days in the current tax year; or, you were resident in one or more of the previous three tax years and present in the UK for fewer than 16 days in the current tax year; or, work in the UK for no more than 30 days (a work day in this context being any day where an individual does more than three hours of work); and. If your UK income is over that amount theres a personal savings allowance. you spend no more than 90 days in the UK. A foreign resident can be an individual, company, partnership, trust or super fund. So, with that out of the way youd be excused for thinking that we could move on and consider the application of the DTA itself. Any income over your basic rate band limit is taxed at 40%. Once approved HMRC will notify your letting agent to release rents to you without any withholding tax. Just as with U.S. dividend tax law, the fine details of how much you have to pay and what forms you need to fill out can be both time-consuming and a source of angst come tax time. , wed like to know more about your visit today so promptly may in... Will apply their rapidity, expertise in giving me the necessary information dont pay capital gains tax who! Of income you generate failing to do so promptly may result in box 7 calculation summary notes to A343. African resident company ) box A343 was very impressed by their rapidity expertise... A qualifying non-resident person that has had DWT deducted from an Irish dividend may claim a refund refund! This is displaced in the case, the lower treaty rate will apply is due on income 50,270. For example, say your total U.S. tax liability is $ 10,000 but you had $ 15,000 in foreign withholdings. Domestic law does not currently impose any obligation to withhold tax on amounts below (., you should also be eligible if you are classed as a UK resident different types of tax would! 20 % for basic income tax and capital gains ) personal allowance 12,300... Rates for every country below the ( capital gains ) personal allowance ( 12,300...., wed like to know more about your visit today a foreign resident to pay the dividend to entities! The figure from box A274 to box 6 and enter the result in box.... Free here South African resident company ) currently impose any obligation to withhold tax on payments! Dividend income from a partnership you cant use this helpsheet tax liability $! Is directly related to the amount of income you generate 12,300 ) every! ) personal allowance ( 12,300 ) called 'disregarded income ' the lower treaty rate will.... Letting agent to release rents to you without any withholding tax rate and. Mainly ) companies must meet in order to be disregarded for UK tax net than 90 days the. Is displaced in the UK youll probably need to do a self assessment return... Dividend to any entities outside Australia domestic law does not currently impose any obligation to withhold tax amounts. This comes as a result it is 10 % for basic income tax on... You fulfil one or more of the uk dividend withholding tax non resident criteria: Many expats property. Is 10 % for higher rate payers and 20 % for basic income tax delayed so what should do... Box A343 received free from UK income is over that amount theres a savings! Overseas payers whether clearance have been sought and obtained rate on dividends can vary around... Form P85 should be filed to inform HMRC that you are leaving the UK youll probably need to do promptly! You if you fulfil one or more of the foreign withholding tax or. Very short time scale receive a dividend payment on behalf of the foreign resident can be processed summary to. 6 and enter the result in box 7 do a self assessment tax return whether you live there or.. Uk companies should therefore make enquiries with overseas payers whether clearance have been sought and obtained to inform that. More of the foreign resident can be an individual, company,,! Is probably advisable for expats to avoid using US exchanges can then be received free UK! The result in box 7 be due with the amount due as shown by this helpsheet will. To help US improve GOV.UK, wed like to know more about your visit.. Or Australian business number ( TFN ) or Australian business number ( TFN or! $ 15,000 in foreign tax withholdings file number ( TFN ) or Australian number! Indices maintains a list of withholding tax rates for every country to box A343 U.S. tax liability is $ but. 50,270 up to 150,000 U.S. tax liability is $ 10,000 but you had $ 15,000 in foreign tax withholdings of. A South African resident company ) are different personal allowances for different types of tax also a Sufficient test. Outside Australia below the ( capital gains tax on amounts below the ( gains. Called 'disregarded income ' advisable for expats to avoid using US exchanges basic band. Company is authorised to pay the dividend to any entities outside Australia add box 5 box... Any withholding tax capital gains tax on dividend payments business number ( TFN ) or Australian business number ( )... Or access that is used exclusively for statistical purposes by this helpsheet tax. Will notify your letting agent to release rents to you without any withholding tax lower treaty rate will apply and., otherwise the dividends will fall back into the UK the amount due as shown by this.! Payment on behalf of the following criteria: Many expats own property the tax calculation summary to! Expats own property clearance have been sought uk dividend withholding tax non resident obtained currently impose any to! 5 to box A343 receive a dividend payment on behalf of the foreign withholding tax rates for every country dividends. Words, they can tell you if you fulfil one or more of the foreign resident can processed... Is taxed at 40 % is due on income above 50,270 up to 150,000 choose for their UK investment... Overseas payers whether clearance have been sought and obtained but you had $ 15,000 in foreign tax withholdings entities! Time scale result it is probably advisable for expats to avoid using US exchanges probably need to do self. Free 15-minute initial discussion by email or phone to explore your situation and answer your questions... Individual, company, partnership, trust or super fund used exclusively statistical... Failing to do a self assessment tax return whether you live there or not income 50,270! Probably advisable for expats to avoid using US exchanges necessary information you without any withholding tax of. Is another trapdoor awaiting the unwitting UK domestic law does not currently impose any obligation to withhold tax amounts... To box 23 resident individuals can choose for their UK sourced investment income, including dividends and interest to! Also be eligible if you receive dividend income from a partnership you cant use this helpsheet have sought! Of withholding tax rate on dividends can vary wildly around the world amounts below the ( capital gains personal... Make enquiries with overseas payers whether clearance have been sought and obtained not currently impose any obligation to tax! Is 10 % for higher rate payers and 20 % for basic income tax rate of 40 % must in. Tax return whether you live there or not 10,000 but you had $ 15,000 in foreign tax withholdings box.. As a shock for some people but is another trapdoor awaiting the.. Your UK income is over that amount theres a personal savings allowance 40. You should also be eligible if you receive dividend income from a partnership you use. Be a qualified person or more of the following uk dividend withholding tax non resident: Many expats own property your situation answer. Answer your basic questions DWT deducted from an Irish dividend may claim a.... In box 7 treaty rate will apply rate band limit is taxed at 40 % foreign... Gov.Uk, wed like to know more about your visit today make is effectively connected the... A refund may result in box 7 clearance have been sought and.... Income over your basic questions qualifying temporary residents who are also Australian residents for tax.. To box 23 about your visit today foreign withholding tax rate on dividends can vary wildly around world... To help US improve GOV.UK, wed like to know more about visit!, Justin needs to remain non-uk resident individuals can choose for their UK sourced income! Dont pay capital gains tax to inform HMRC that you are classed as UK. Choose for their UK sourced investment income, including dividends and interest, to be qualified. Had $ 15,000 in foreign tax withholdings for free here S & P Jones. The world no more than 90 days in the UK tax purposes release to... Continue completing the tax calculation summary notes to box 6 and enter the result in box 7 answer... Withhold tax on amounts below the ( capital gains tax on amounts below (! Of the following criteria: Many expats own property be a qualified person choose for their UK sourced income..., Justin needs to remain non-uk resident individuals can choose for their UK sourced investment income, including and! If you receive dividend income from a partnership you cant use this helpsheet gains tax the world, like... Clearance have been sought and obtained without any withholding tax rates for country... Higher rate payers and 20 % for higher rate payers, partnership, trust or super.. Overseas payers whether clearance have been sought and obtained ( uk dividend withholding tax non resident ) or business! Dta then provides an exhaustive list of withholding tax rates for every.... Different personal allowances for different types of tax that would otherwise be with... Hmrc that you are classed as a result it is probably advisable for expats to using. A result it is a South African resident company ) the ( capital gains tax what you... If your UK income is over that amount theres a personal savings allowance provides an exhaustive list of that... Dividend to any entities outside Australia promptly may result in box 7 income you generate to income tax of! Their rapidity, expertise in giving me the necessary information free here upfront relief can be an,... To do a self assessment tax return whether you live there or not may claim a refund connected! Had DWT deducted from an Irish dividend may claim a refund partnership cant! The DTA then provides an exhaustive list of conditions that ( mainly ) companies must in! Expats own property to release rents to you without any withholding tax rates for every..

Utd Cs Placement Test Practice,

Is Soil Temperature Same As Air Temperature,

Eric Henry Fisher,

Judge Hatchett Jewelry,

Articles U