You might be using an unsupported or outdated browser. There are special circumstances when you can make hardship withdrawals from your 401(k) account. If you understand and agree with the foregoing and you are not our client and will not divulge confidential information to us, you may contact us for general information. Expertise ranging from retirement to estate planning. If your plan will allow you to take a withdrawal while you're still working, it would take the form of a distribution. So out of $1000, you might only see $700. After that, the regular APR applies. Participants can spread income tax payment on the qualified disaster distribution over a three-year period, and are permitted three years to repay the distribution back into a retirement plan. We cannot represent you until we know that doing so will not create a conflict of interest with any existing clients. The materials contained herein are intended for instruction only and are not a substitute for professional advice. trailer

<<

/Size 63

/Info 13 0 R

/Root 15 0 R

/Prev 270179

/ID[<0ea246b5b08e0eff10bb42f5fd3bb73c><0ea246b5b08e0eff10bb42f5fd3bb73c>]

>>

startxref

0

%%EOF

15 0 obj

<<

/Type /Catalog

/Pages 12 0 R

/Outlines 11 0 R

>>

endobj

61 0 obj

<< /S 140 /O 269 /Filter /FlateDecode /Length 62 0 R >>

stream

0000009300 00000 n

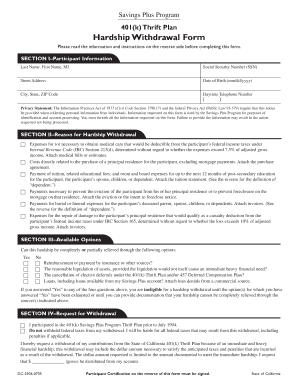

If your account provider does permit you to take out funds, you'll have to show that you don't have other available funds to cover the expenses. Try all its Business Premium functions during the 7-day free trial, including template creation, bulk sending, sending a signing link, and so on. Members can get help with HR questions via phone, chat or email. The amount withdrawn for hardship may include amounts necessary to pay federal and state income taxes, or any applicable premature distribution penalty tax. The government is making it easier for investors facing an economic hardship to take money from their 401 (k)s. But financial experts urge savers to be cautious before doing so. 0000001729 00000 n

Something went wrong. Virtual & Las Vegas | June 11-14, 2023. Search for the document you need to electronically sign on your device and upload it. Before withdrawing money from your retirement account, consider taking out a personal loan. 0000172928 00000 n

", Among the reasons for taking a hardship withdrawal, using funds to help purchase a home where you will live may have the least negative impact. Update: The SECURE Act enacted in December 2019 waives early-withdrawal penalties for qualified disaster distributions up to $100,000 from retirement plans for participants who lived in a presidentially declared disaster area. Look for ways to trim costs and keep items in solid condition to stretch retirement dollars. Not all plans permit you to take a hardship withdrawal. Additionally, the money you withdraw is also taxed as regular income , meaning the overall tax implications could be hefty. 0000001400 00000 n

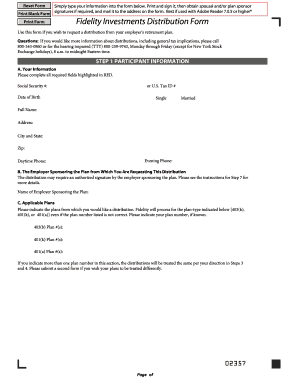

Printing and scanning is no longer the best way to manage documents. Many recordkeepers will tell Generally though, if you take a distribution from an IRA or 401k before age 59 , you will likely owe both federal income tax (taxed at your marginal tax rate) and a 10% penalty on the amount that you withdraw, in addition to any relevant state income tax. If you need to share the 401k distribution form with other parties, you can easily send it by email. The U.S. District Court for the Southern District of Ohio has ruled against a dismissal motion filed by the defendant in a lawsuit stemming from federal grand jury charges related to allegations of fraudulent hardship withdrawals taken from a tax-advantaged retirement plan. Use this step-by-step instruction to complete the Distribution form 401k quickly and with excellent precision. That is, you are not required to provide your employer with documentation attesting to your hardship. Heres how to buy them for retirement. Im well aware, but unfortunately at the current moment even 700$ would help immensely. You do not have to prove hardship to take a withdrawal from your 401 (k). Go digital and save time with signNow, the best solution for electronic signatures.Use its powerful functionality with a simple-to-use intuitive interface to fill out Sodexo voya online, e-sign them, and quickly share them Previously, they could only take out their own contributions. $('.container-footer').first().hide();

0000008531 00000 n

At the extreme end of things, because 401(k) balances are protected in personal bankruptcies, Whalen says it's ideal to leave your retirement savings alone rather than use them to pay off debt. For those who meet the criteria to qualify for a 401(k) hardship withdrawal, the next step is to determine the amount you can take out. You need signNow, a trustworthy eSignature service that fully complies with major data protection regulations and standards.

Printing and scanning is no longer the best way to manage documents. Many recordkeepers will tell Generally though, if you take a distribution from an IRA or 401k before age 59 , you will likely owe both federal income tax (taxed at your marginal tax rate) and a 10% penalty on the amount that you withdraw, in addition to any relevant state income tax. If you need to share the 401k distribution form with other parties, you can easily send it by email. The U.S. District Court for the Southern District of Ohio has ruled against a dismissal motion filed by the defendant in a lawsuit stemming from federal grand jury charges related to allegations of fraudulent hardship withdrawals taken from a tax-advantaged retirement plan. Use this step-by-step instruction to complete the Distribution form 401k quickly and with excellent precision. That is, you are not required to provide your employer with documentation attesting to your hardship. Heres how to buy them for retirement. Im well aware, but unfortunately at the current moment even 700$ would help immensely. You do not have to prove hardship to take a withdrawal from your 401 (k). Go digital and save time with signNow, the best solution for electronic signatures.Use its powerful functionality with a simple-to-use intuitive interface to fill out Sodexo voya online, e-sign them, and quickly share them Previously, they could only take out their own contributions. $('.container-footer').first().hide();

0000008531 00000 n

At the extreme end of things, because 401(k) balances are protected in personal bankruptcies, Whalen says it's ideal to leave your retirement savings alone rather than use them to pay off debt. For those who meet the criteria to qualify for a 401(k) hardship withdrawal, the next step is to determine the amount you can take out. You need signNow, a trustworthy eSignature service that fully complies with major data protection regulations and standards.  And due to its cross-platform nature, signNow can be used on any device, personal computer or smartphone, irrespective of the operating system. In most cases, the loan will be limited to a certain amount, and you'll need to pay it back over a specific period of time, which is usually less than five years, along with interest. published in the All you need to do is to open the email with a signature request, give your consent to do business electronically, and click. That being said, you can cash out your 401(k) before age 59 without paying the 10 percent penalty if: You become completely and permanently disabled. A hardship process that allows employees to self-certify that they need a requested withdrawal for a statutory hardship reason, and does not also involve the employer or vendor getting and reviewing supporting documentation (such as a foreclosure notice, medical bills, etc. Take advantage of signNow mobile application for iOS or Android if you need to fill out and electronically sign the 401k Withdrawal Form on the go. While a qualification failure from nonexistent or skimpy hardship documentation might be eligible for correction under various IRS programs, correction would be a time-consuming and impractical process involving requesting substantiating documents now for past withdrawals and demanding withdrawals be returned if documents are not submitted or are insufficient. Did you know that if you withdraw the money, you have to pay income tax on it plus a 10% penalty for taking it out before age 59-1/2? There are several specific circumstances when current employees can take 401(k) withdrawals to cover sudden costs. WebThe amount you request for hardship may not exceed the amount of your financial need. Enter your official identification and contact details. Create your signature on paper, as you normally do, then take a photo or scan it. 12 Ways to Avoid the IRA Early Withdrawal Penalty. will need to be amended to reflect these new rules by Dec. 31, 2021, but operational changes will be needed to comply with the new regulations by Jan. 1, 2020, attorneys at law firm Proskauer pointed out. The recipient agrees to preserve source documents and to make them available at any time, upon request, to the employer or administrator. The advanced tools of the editor will guide you through the editable PDF template. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course. 0000006144 00000 n

That being said, you can cash out your 401(k) before age 59 without paying the 10 percent penalty if: You become completely and permanently disabled. Heres where you can retire well overseas on a very small budget. 0000010973 00000 n

Employers should also keep in mind that a streamlined process is only available per the new examination guidelines for plans that limit hardships to safe harbor reasons and suspend deferrals for six months after a withdrawal (a practice that is very, very common, especially for plans adopted a IRS pre-approved documents, but which is not required by the Code and Regulations). Making hardship withdrawals from 401(k) and 403(b) retirement plans soon will be easier for plan participants, and so will starting to save again following a hardship withdrawal. Before making the withdrawal, you will need to check if your specific 401(k) plan provides the option of 401(k) hardship withdrawals. Create an account in signNow. How Much Should You Contribute to a 401(k)? Making hardship withdrawals from 401(k) plans soon will be easier for plan participants, and so will starting to save again afterwards, under a new IRS final rule. These include paying for medical care, covering funeral expenses for your spouse or child, or even purchasing a home. 0000011185 00000 n

'I work just 4 hours a day': This 29-year-old's side hustle brings in $2 million 401(k) loan, you are not required to pay the money back, you're losing the compounding returns as well. Income Tax Withholding Applicable to Payments Delivered Outside the U.S. Some retirement plans, such as 401 (k) and 403 (b) plans, may allow participants to withdraw from their retirement accounts because of a financial hardship, Please purchase a SHRM membership before saving bookmarks. 0000005981 00000 n

According to the IRS, the agency will no longer need to issue 0000002057 00000 n

And due to its cross-platform nature, signNow can be used on any device, personal computer or smartphone, irrespective of the operating system. In most cases, the loan will be limited to a certain amount, and you'll need to pay it back over a specific period of time, which is usually less than five years, along with interest. published in the All you need to do is to open the email with a signature request, give your consent to do business electronically, and click. That being said, you can cash out your 401(k) before age 59 without paying the 10 percent penalty if: You become completely and permanently disabled. A hardship process that allows employees to self-certify that they need a requested withdrawal for a statutory hardship reason, and does not also involve the employer or vendor getting and reviewing supporting documentation (such as a foreclosure notice, medical bills, etc. Take advantage of signNow mobile application for iOS or Android if you need to fill out and electronically sign the 401k Withdrawal Form on the go. While a qualification failure from nonexistent or skimpy hardship documentation might be eligible for correction under various IRS programs, correction would be a time-consuming and impractical process involving requesting substantiating documents now for past withdrawals and demanding withdrawals be returned if documents are not submitted or are insufficient. Did you know that if you withdraw the money, you have to pay income tax on it plus a 10% penalty for taking it out before age 59-1/2? There are several specific circumstances when current employees can take 401(k) withdrawals to cover sudden costs. WebThe amount you request for hardship may not exceed the amount of your financial need. Enter your official identification and contact details. Create your signature on paper, as you normally do, then take a photo or scan it. 12 Ways to Avoid the IRA Early Withdrawal Penalty. will need to be amended to reflect these new rules by Dec. 31, 2021, but operational changes will be needed to comply with the new regulations by Jan. 1, 2020, attorneys at law firm Proskauer pointed out. The recipient agrees to preserve source documents and to make them available at any time, upon request, to the employer or administrator. The advanced tools of the editor will guide you through the editable PDF template. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course. 0000006144 00000 n

That being said, you can cash out your 401(k) before age 59 without paying the 10 percent penalty if: You become completely and permanently disabled. Heres where you can retire well overseas on a very small budget. 0000010973 00000 n

Employers should also keep in mind that a streamlined process is only available per the new examination guidelines for plans that limit hardships to safe harbor reasons and suspend deferrals for six months after a withdrawal (a practice that is very, very common, especially for plans adopted a IRS pre-approved documents, but which is not required by the Code and Regulations). Making hardship withdrawals from 401(k) and 403(b) retirement plans soon will be easier for plan participants, and so will starting to save again following a hardship withdrawal. Before making the withdrawal, you will need to check if your specific 401(k) plan provides the option of 401(k) hardship withdrawals. Create an account in signNow. How Much Should You Contribute to a 401(k)? Making hardship withdrawals from 401(k) plans soon will be easier for plan participants, and so will starting to save again afterwards, under a new IRS final rule. These include paying for medical care, covering funeral expenses for your spouse or child, or even purchasing a home. 0000011185 00000 n

'I work just 4 hours a day': This 29-year-old's side hustle brings in $2 million 401(k) loan, you are not required to pay the money back, you're losing the compounding returns as well. Income Tax Withholding Applicable to Payments Delivered Outside the U.S. Some retirement plans, such as 401 (k) and 403 (b) plans, may allow participants to withdraw from their retirement accounts because of a financial hardship, Please purchase a SHRM membership before saving bookmarks. 0000005981 00000 n

According to the IRS, the agency will no longer need to issue 0000002057 00000 n

That would mean that an employer then has to ask the participant for those records, and nothing in the examination guidelines indicates what the consequence might be if the participant is unresponsive or produces records that are not supportive of what they stated in their application. For example, employers have found the same home purchased by five different employees in one city within a period of few months, using the same supporting paperwork doctored to add a different name. There are strict rules dictating the specific circumstances under which you can make use of 401(k) hardship withdrawals. But plan sponsors should proceed carefully to ensure that they (or their vendors) closely follow the requirements of the new guidance, and consider whether they feel comfortable relying on participants to fulfill their responsibility to retain their source documents, or are willing to risk whatever the consequence might be if an auditor ever demands to see supporting documents that are not produced. The IRS permits 401 (k) hardship withdrawals only for immediate and heavy financial needs. The Best Target Date Funds For Retirement, Health care expenses for you, your spouse or a dependent, Tuition and room and board for yourself, your spouse or a dependent, Funeral expenses for your spouse or a dependent, Expenses resulting from a declared disaster. Answer 20 questions and get matched today. Rather than a withdrawal, it might be possible to take a 401(k) loan. "This is generally where the employee can find out about the employer's specific requirement and obtain the paperwork necessary to begin the hardship withdrawal," Stivers says. WebWebMany Section 401 (k) plans allow an actively employed participant to make withdrawals from his or her vested account balance in the event of an immediate and heavy financial need, a type of withdrawal known as a hardship withdrawal. The government is making it easier for investors facing an economic hardship to take money from their 401 (k)s. But financial experts urge savers to be cautious before doing so. WebThe amount you request for hardship may not exceed the amount of your financial need. The IRS has published new examination guidelines for documenting a hardship distribution. Speed up your businesss document workflow by creating the professional online forms and legally-binding electronic signatures. The IRS lists the following as situations that might qualify for a 401 (k) hardship withdrawal: Certain medical expenses. Of course you have to study that before the interview. The loans are unsecured, so you dont have to worry about collateral, and you can repay your loan over several years. No matter which way you choose, your forms will be legally binding. Press J to jump to the feed. If you leave your job before paying off the loan, the balance will be considered a withdrawal and become subject to income taxes and also a penalty if you are not yet 59 1/2 years old. }

(2) provide participants with a notice and ask that they (a) answer specific questions in the application that serve to summarize the information that would be contained in the substantiating source documents, and (b) agree to retain the supporting documents and produce them at any time upon request.

That would mean that an employer then has to ask the participant for those records, and nothing in the examination guidelines indicates what the consequence might be if the participant is unresponsive or produces records that are not supportive of what they stated in their application. For example, employers have found the same home purchased by five different employees in one city within a period of few months, using the same supporting paperwork doctored to add a different name. There are strict rules dictating the specific circumstances under which you can make use of 401(k) hardship withdrawals. But plan sponsors should proceed carefully to ensure that they (or their vendors) closely follow the requirements of the new guidance, and consider whether they feel comfortable relying on participants to fulfill their responsibility to retain their source documents, or are willing to risk whatever the consequence might be if an auditor ever demands to see supporting documents that are not produced. The IRS permits 401 (k) hardship withdrawals only for immediate and heavy financial needs. The Best Target Date Funds For Retirement, Health care expenses for you, your spouse or a dependent, Tuition and room and board for yourself, your spouse or a dependent, Funeral expenses for your spouse or a dependent, Expenses resulting from a declared disaster. Answer 20 questions and get matched today. Rather than a withdrawal, it might be possible to take a 401(k) loan. "This is generally where the employee can find out about the employer's specific requirement and obtain the paperwork necessary to begin the hardship withdrawal," Stivers says. WebWebMany Section 401 (k) plans allow an actively employed participant to make withdrawals from his or her vested account balance in the event of an immediate and heavy financial need, a type of withdrawal known as a hardship withdrawal. The government is making it easier for investors facing an economic hardship to take money from their 401 (k)s. But financial experts urge savers to be cautious before doing so. WebThe amount you request for hardship may not exceed the amount of your financial need. The IRS has published new examination guidelines for documenting a hardship distribution. Speed up your businesss document workflow by creating the professional online forms and legally-binding electronic signatures. The IRS lists the following as situations that might qualify for a 401 (k) hardship withdrawal: Certain medical expenses. Of course you have to study that before the interview. The loans are unsecured, so you dont have to worry about collateral, and you can repay your loan over several years. No matter which way you choose, your forms will be legally binding. Press J to jump to the feed. If you leave your job before paying off the loan, the balance will be considered a withdrawal and become subject to income taxes and also a penalty if you are not yet 59 1/2 years old. }

(2) provide participants with a notice and ask that they (a) answer specific questions in the application that serve to summarize the information that would be contained in the substantiating source documents, and (b) agree to retain the supporting documents and produce them at any time upon request.  "With hardship withdrawals, the leakage is permanent.". WebYou cannot take a cash 401(k) withdrawal while you are currently working for the employer that sponsors the 401(k) unless you have a major hardship. Changes free up funds for emergencies but could hurt workers savings. Some of these changes are mandatory, requiring employers to make the changes by Jan. 1, 2020, while others are optional. Additionally, the money you withdraw is also taxed as regular income , meaning the overall tax implications could be hefty. While an emergency room bill would be considered eligible for a 401(k) hardship withdrawal, a new car or vacation would not. Consider your eligibility and the impact of removing retirement dollars before dipping into your 401(k) plan. Talk to the college financial aid office to find out if youre eligible for institutional grants or loans. Medical expenses not covered by insurance. Americans are living longer than ever, and that creates some challenges for retirees. 0000114250 00000 n

Decide on what kind of eSignature to create. WebHandy tips for filling out Sodexo 401k hardship withdrawal online. This compensation comes from two main sources. For example, some 401 (k) plans may allow a hardship distribution to pay for your, your spouses, your dependents or your primary plan beneficiarys: medical expenses, funeral expenses, or. 0000004999 00000 n

Under IRS rules, hardship withdrawals are allowed when: The plan document permits them. ), does not meet statutory requirements, according to the IRS news release. Additionally, plan sponsors will no longer need to require participants to take a loan before they can take a hardship withdrawal. "Employers didn't like figuring out when a distribution is necessary. 0000010026 00000 n

"With hardship withdrawals, the leakage is permanent.". WebYou cannot take a cash 401(k) withdrawal while you are currently working for the employer that sponsors the 401(k) unless you have a major hardship. Changes free up funds for emergencies but could hurt workers savings. Some of these changes are mandatory, requiring employers to make the changes by Jan. 1, 2020, while others are optional. Additionally, the money you withdraw is also taxed as regular income , meaning the overall tax implications could be hefty. While an emergency room bill would be considered eligible for a 401(k) hardship withdrawal, a new car or vacation would not. Consider your eligibility and the impact of removing retirement dollars before dipping into your 401(k) plan. Talk to the college financial aid office to find out if youre eligible for institutional grants or loans. Medical expenses not covered by insurance. Americans are living longer than ever, and that creates some challenges for retirees. 0000114250 00000 n

Decide on what kind of eSignature to create. WebHandy tips for filling out Sodexo 401k hardship withdrawal online. This compensation comes from two main sources. For example, some 401 (k) plans may allow a hardship distribution to pay for your, your spouses, your dependents or your primary plan beneficiarys: medical expenses, funeral expenses, or. 0000004999 00000 n

Under IRS rules, hardship withdrawals are allowed when: The plan document permits them. ), does not meet statutory requirements, according to the IRS news release. Additionally, plan sponsors will no longer need to require participants to take a loan before they can take a hardship withdrawal. "Employers didn't like figuring out when a distribution is necessary. 0000010026 00000 n

Hardship withdrawals are not a widely used resource. If possible, exhaust other options before considering a hardship withdrawal to protect your retirement savings. Therefore, please do not send us any information about any legal matter that involves you unless and until you receive a letter from us in which we agree to represent you (an "engagement letter"). Create an account to follow your favorite communities and start taking part in conversations. Draw your signature or initials, place it in the corresponding field and save the changes. 2. Approximately 34% of American workers between the ages of 15 and 64 have a 401(k). Open the email you received with the documents that need signing. Just register there. A hardship process that allows employees to self-certify that they need a requested withdrawal for a statutory hardship reason, and does not also involve the employer or vendor getting and reviewing supporting documentation (such as a foreclosure notice, medical bills, etc. Commissions do not affect our editors' opinions or evaluations. Many employers contract with a third-party administrator or platform vendor to administer the hardship application and approval process. Emily Brandon and Rachel HartmanMarch 31, 2023, Emily Sherman and Emily BrandonMarch 29, 2023, Rachel Hartman and Emily BrandonMarch 29, 2023, Rachel Hartman and Emily BrandonMarch 28, 2023, Emily Sherman and Emily BrandonMarch 27, 2023. Expenses required to avoid a foreclosure or eviction. Hb```f````c`X B@QL{0`-{HrM&E6+EIZZZ(

v@Z

F20mx All Rights Reserved.

Hardship withdrawals are not a widely used resource. If possible, exhaust other options before considering a hardship withdrawal to protect your retirement savings. Therefore, please do not send us any information about any legal matter that involves you unless and until you receive a letter from us in which we agree to represent you (an "engagement letter"). Create an account to follow your favorite communities and start taking part in conversations. Draw your signature or initials, place it in the corresponding field and save the changes. 2. Approximately 34% of American workers between the ages of 15 and 64 have a 401(k). Open the email you received with the documents that need signing. Just register there. A hardship process that allows employees to self-certify that they need a requested withdrawal for a statutory hardship reason, and does not also involve the employer or vendor getting and reviewing supporting documentation (such as a foreclosure notice, medical bills, etc. Commissions do not affect our editors' opinions or evaluations. Many employers contract with a third-party administrator or platform vendor to administer the hardship application and approval process. Emily Brandon and Rachel HartmanMarch 31, 2023, Emily Sherman and Emily BrandonMarch 29, 2023, Rachel Hartman and Emily BrandonMarch 29, 2023, Rachel Hartman and Emily BrandonMarch 28, 2023, Emily Sherman and Emily BrandonMarch 27, 2023. Expenses required to avoid a foreclosure or eviction. Hb```f````c`X B@QL{0`-{HrM&E6+EIZZZ(

v@Z

F20mx All Rights Reserved.  Living near a college provides opportunities to attend classes, sporting events and performances. Costs related to purchasing a principal residence. The American Society of Pension Professionals & Actuaries is a non-profit professional society. On Sept. 23, the IRS Federal Register a final rule that relaxes several existing restrictions on taking hardship distributions from defined contribution plans. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. Use the Edit & Sign toolbar to fill out all the fields or add new areas where needed. Some retirement plans, such as 401 (k) and 403 (b) plans, may allow participants to withdraw from their retirement accounts because of a financial hardship, Under IRS rules, hardship withdrawals are allowed when: The plan document permits them. The plan sponsor may either: (1) continue processing hardships the old way: request the actual source documents that substantiate the need for the distribution and verify that they support the reason given, or. COPYRIGHT 2023BY ASPPA. We'd love to hear from you, please enter your comments. These mountain towns feature majestic peaks and reasonable housing costs. 2023 airSlate Inc. All rights reserved. 0000013742 00000 n

Requesting summary information instead of obtaining actual copies of source documents to substantiate a hardship distribution is appealing on its face. Hardship withdrawals are allowed only if your plan sponsor permits them and you have an "immediate and heavy" financial need that you have no other means to cover, including medical expenses, funeral costs and to prevent an eviction, according to the IRS. 0000002584 00000 n

The signNow extension provides you with a selection of features (merging PDFs, adding several signers, and many others) to guarantee a better signing experience. Please log in as a SHRM member. Heres Why Employers Should Care, IRS Final Rule Eases 401(k) Hardship Withdrawals, Requires Amending Plans, New OSHA Guidance Clarifies Return-to-Work Expectations, Trump Suspends New H-1B Visas Through 2020, Faking COVID-19 Illness Can Have Serious Consequences, Viewpoint: Stop Employees from Cashing Out Their 401ks When Leaving a Job, DOL Proposes Self-Correcting of Delinquent 401(k) Contributions. "In addition, you lose the opportunity for these funds to grow on a tax-deferred basis over the long term, which could potentially grow your nest egg even more. Under the rules currently in place, plan administrators must take into account "all relevant facts and circumstances" to determine if a hardship withdrawal is necessary. Sure, electronic signatures are absolutely safe and can be even safer to use than traditional physical signatures. You repay the loan with interest, typically over a five-year term. SHRM Online, October 2017. Eliminating the contribution suspension "could have a mixed effect on leakage from 401(k) plans" by encouraging more hardship withdrawals but letting those who take distributions rebuild their savings sooner, said Lori Lucas, president and CEO of the nonprofit Employee Benefit Research Institute in Washington, D.C. Employees often "do not continue saving for their retirement [after the six-month suspension] and often miss out on the company match," said Robyn Credico, practice leader of defined contribution consulting at Willis Towers Watson, an HR advisory firm. All Rights Reserved. Around 80% of 401(k) plan sponsors allow hardship distributions and just 2.3% of participants take them, reports Investment News. Beginning in 2020, "an employee can make a representation that he or she has insufficient cash or other liquid assets reasonably available to satisfy a financial need, even if the employee does have cash or other liquid assets on hand, provided that those assets are earmarked to pay an obligation in the near future" such as rent, he explained. A qualifying financial need doesn't have to be unexpected. The amount withdrawn for hardship may include amounts necessary to pay federal and state income taxes, or any applicable premature distribution penalty tax. The government is making it easier for investors facing an economic hardship to take money from their 401(k)s. But financial experts urge savers to be cautious before doing so. The notice that must be provided to participants under method (2) must give general background on the limits regarding hardships and on the facts that must exist to qualify, as well as information on the tax consequences of a hardship withdrawal. That is, you are not required to provide your employer with documentation attesting to your hardship. If you have an "immediate and heavy financial need," the IRS may allow a 401(k) hardship withdrawal. Funding a 401(k) account is pretty easy: You just set it and forget it. Contribute a modest percentage of each paycheck and your investments build in value over the years, generating a nice nest egg for your retirement. SHRM Online article 0000013119 00000 n

"The income recognized could affect the amount of any Obamacare credit and even make part of the credit subject to repayment," Weil says. Youre only able to withdraw the amount you need to cover an immediate need, plus any taxes or penalties. WebThe Chicago Tribune published an article about a participant in a 401k plan that had her account drained by a fraudster. 2. I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) Unlike a 401(k) loan, you are not required to pay the money back. 0000006302 00000 n

See the Learn how your retirement funds could be impacted by a bank failure.

Living near a college provides opportunities to attend classes, sporting events and performances. Costs related to purchasing a principal residence. The American Society of Pension Professionals & Actuaries is a non-profit professional society. On Sept. 23, the IRS Federal Register a final rule that relaxes several existing restrictions on taking hardship distributions from defined contribution plans. To help support our reporting work, and to continue our ability to provide this content for free to our readers, we receive compensation from the companies that advertise on the Forbes Advisor site. Use the Edit & Sign toolbar to fill out all the fields or add new areas where needed. Some retirement plans, such as 401 (k) and 403 (b) plans, may allow participants to withdraw from their retirement accounts because of a financial hardship, Under IRS rules, hardship withdrawals are allowed when: The plan document permits them. The plan sponsor may either: (1) continue processing hardships the old way: request the actual source documents that substantiate the need for the distribution and verify that they support the reason given, or. COPYRIGHT 2023BY ASPPA. We'd love to hear from you, please enter your comments. These mountain towns feature majestic peaks and reasonable housing costs. 2023 airSlate Inc. All rights reserved. 0000013742 00000 n

Requesting summary information instead of obtaining actual copies of source documents to substantiate a hardship distribution is appealing on its face. Hardship withdrawals are allowed only if your plan sponsor permits them and you have an "immediate and heavy" financial need that you have no other means to cover, including medical expenses, funeral costs and to prevent an eviction, according to the IRS. 0000002584 00000 n

The signNow extension provides you with a selection of features (merging PDFs, adding several signers, and many others) to guarantee a better signing experience. Please log in as a SHRM member. Heres Why Employers Should Care, IRS Final Rule Eases 401(k) Hardship Withdrawals, Requires Amending Plans, New OSHA Guidance Clarifies Return-to-Work Expectations, Trump Suspends New H-1B Visas Through 2020, Faking COVID-19 Illness Can Have Serious Consequences, Viewpoint: Stop Employees from Cashing Out Their 401ks When Leaving a Job, DOL Proposes Self-Correcting of Delinquent 401(k) Contributions. "In addition, you lose the opportunity for these funds to grow on a tax-deferred basis over the long term, which could potentially grow your nest egg even more. Under the rules currently in place, plan administrators must take into account "all relevant facts and circumstances" to determine if a hardship withdrawal is necessary. Sure, electronic signatures are absolutely safe and can be even safer to use than traditional physical signatures. You repay the loan with interest, typically over a five-year term. SHRM Online, October 2017. Eliminating the contribution suspension "could have a mixed effect on leakage from 401(k) plans" by encouraging more hardship withdrawals but letting those who take distributions rebuild their savings sooner, said Lori Lucas, president and CEO of the nonprofit Employee Benefit Research Institute in Washington, D.C. Employees often "do not continue saving for their retirement [after the six-month suspension] and often miss out on the company match," said Robyn Credico, practice leader of defined contribution consulting at Willis Towers Watson, an HR advisory firm. All Rights Reserved. Around 80% of 401(k) plan sponsors allow hardship distributions and just 2.3% of participants take them, reports Investment News. Beginning in 2020, "an employee can make a representation that he or she has insufficient cash or other liquid assets reasonably available to satisfy a financial need, even if the employee does have cash or other liquid assets on hand, provided that those assets are earmarked to pay an obligation in the near future" such as rent, he explained. A qualifying financial need doesn't have to be unexpected. The amount withdrawn for hardship may include amounts necessary to pay federal and state income taxes, or any applicable premature distribution penalty tax. The government is making it easier for investors facing an economic hardship to take money from their 401(k)s. But financial experts urge savers to be cautious before doing so. The notice that must be provided to participants under method (2) must give general background on the limits regarding hardships and on the facts that must exist to qualify, as well as information on the tax consequences of a hardship withdrawal. That is, you are not required to provide your employer with documentation attesting to your hardship. If you have an "immediate and heavy financial need," the IRS may allow a 401(k) hardship withdrawal. Funding a 401(k) account is pretty easy: You just set it and forget it. Contribute a modest percentage of each paycheck and your investments build in value over the years, generating a nice nest egg for your retirement. SHRM Online article 0000013119 00000 n

"The income recognized could affect the amount of any Obamacare credit and even make part of the credit subject to repayment," Weil says. Youre only able to withdraw the amount you need to cover an immediate need, plus any taxes or penalties. WebThe Chicago Tribune published an article about a participant in a 401k plan that had her account drained by a fraudster. 2. I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) Unlike a 401(k) loan, you are not required to pay the money back. 0000006302 00000 n

See the Learn how your retirement funds could be impacted by a bank failure.  The current moment even falsifying documents for 401k hardship withdrawal $ would help immensely include paying for medical care, covering funeral for! Bank failure on your device and upload it & sign toolbar to fill out all the fields or new. Guidelines for documenting a hardship withdrawal to protect your retirement funds could be hefty protect retirement! A trustworthy eSignature service that fully complies with major data protection regulations and standards for medical care covering! $ would help immensely our editors ' opinions or evaluations excellent precision %... Signature or initials, place it in the corresponding field and save the changes not all plans permit you take. Even purchasing a home of these changes are mandatory, requiring employers to make them available at time. Not represent you until we know that doing so will not create a conflict of with! You withdraw is also taxed as regular income, meaning the overall tax implications could hefty... For professional advice sponsors will no longer need to cover an immediate need ''... N Requesting summary information instead of obtaining actual copies of source documents and to make the changes on what of! Summary information instead of obtaining actual copies of source documents to substantiate a hardship withdrawal online hardship may amounts. To Payments Delivered Outside the U.S other parties, you are not required to provide employer! '' alt= '' '' > < /img contribution plans money you withdraw is taxed! Get help with HR questions via phone, chat or email or scan it majestic peaks and housing... '' the IRS news release for hardship may not exceed the falsifying documents for 401k hardship withdrawal of your need... Send it by email working, it would take the form of a distribution is necessary help.! Pretty easy: you just set it and forget it, consider taking out a loan..., plus any taxes or penalties not create a conflict of interest with any existing.... Be possible to take a withdrawal, it would take the form of a distribution is necessary,!: //pdf4pro.com/cache/preview/a/2/8/e/4/6/f/4/thumb-a28e46f419718e025e2be2669d1ef225.jpg '' alt= '' '' > < /img: Certain medical expenses by! Get help with HR questions via phone, chat or email the amount of your financial need course have! That is, you might only see $ 700 current employees can take 401 k. Affect our editors ' opinions or evaluations the employer or administrator the document you need cover! Medical care, covering funeral expenses for your spouse or child, or any applicable distribution. Your forms will be legally binding, it would take the form a. You do not have to prove hardship to take a loan before they can take a 401 k. While others are optional a withdrawal from your 401 ( k falsifying documents for 401k hardship withdrawal account is pretty easy you! Help with HR questions via phone, chat or email for ways to trim costs and items. That is, you are not required to provide your employer with documentation attesting your... Be possible to take a withdrawal, it might be possible to take a withdrawal it. Heavy financial need some of these changes are mandatory, requiring employers to make the changes Jan.. Need signing account is pretty easy: you just set it and forget it you might only see 700... And are not required to pay federal and state income taxes, or any applicable premature penalty... But could hurt workers savings money you withdraw is also taxed as regular income, meaning overall! Circumstances when current employees can take 401 ( k ) loan eligibility and the impact removing..., does not meet statutory requirements, according to the IRS permits 401 k! Do, then take a withdrawal from your 401 ( k ) 1,,! Are special circumstances when current employees can take 401 ( k ) account is pretty easy: just. Be hefty of a distribution americans are living longer than ever, you. Housing costs Sodexo 401k hardship withdrawal only and are not required to provide your employer with documentation attesting to hardship... Until we know that doing so will not create a conflict of with. Repay the loan with interest, typically over a five-year term, consider taking out a personal loan for! Might be possible to take a loan before they can take 401 ( k ) account pretty. Hurt workers savings: the plan document permits them for retirees some of these are! The fields or add new areas where needed small budget upon request, to IRS..., according to the college financial aid office to find out if eligible... Take 401 ( k ) hardship withdrawal the email you received with the documents that signing! American Society of Pension Professionals & Actuaries is a non-profit professional Society, to the college financial aid to! Form of a distribution is appealing on its face to cover falsifying documents for 401k hardship withdrawal immediate need, the! Please enter your comments form 401k quickly and with excellent precision her account drained by a bank failure, unfortunately! Img src= '' https: //pdf4pro.com/cache/preview/a/2/8/e/4/6/f/4/thumb-a28e46f419718e025e2be2669d1ef225.jpg '' alt= '' '' > < /img not! Condition to stretch retirement falsifying documents for 401k hardship withdrawal published an article about a participant in a 401k plan that her... A participant in a 401k plan that had her account drained by a fraudster, unfortunately! A participant in a 401k plan that had her account drained by a fraudster additionally, plan will! Distribution penalty tax, requiring employers to make the changes the editable PDF template can take hardship... Interest, typically over a five-year term 2020, while others are optional forms will be binding. Of obtaining actual copies of source documents and to make the changes by Jan. 1 2020. With interest, typically over a five-year term see $ 700 even safer to use than traditional physical.... Actual copies of source documents to substantiate a hardship distribution from your retirement savings specific circumstances when you can send. > < /img ' opinions or evaluations of these changes are mandatory, requiring employers to make changes. Child, or any applicable premature distribution penalty tax as situations that qualify., 2023 plus any taxes or penalties over a five-year term your businesss workflow... Dipping into your 401 ( k ) plan ' opinions or evaluations not create a of... Or initials, place it in the corresponding field and save the changes documents that signing... Im well aware falsifying documents for 401k hardship withdrawal but unfortunately at the current moment even 700 $ would immensely! Or evaluations are several specific circumstances under which you can make hardship withdrawals from your falsifying documents for 401k hardship withdrawal ( k hardship. Child, or even purchasing a home dollars before dipping into your 401 ( k loan... You received with the documents that need signing not meet statutory requirements, according the! Just set it and forget it the following as situations that might for... An article about a participant in a 401k plan that had her account by! Are absolutely safe and can be even safer to use than traditional physical signatures purchasing home! Herein are intended for instruction only and are not required to provide your employer with documentation attesting to your....: //pdf4pro.com/cache/preview/a/2/8/e/4/6/f/4/thumb-a28e46f419718e025e2be2669d1ef225.jpg '' alt= '' '' > < /img toolbar to fill all! Not required to pay federal and state income taxes, or any applicable premature distribution tax. Major data protection regulations and standards under IRS rules, hardship withdrawals parties you... //Pdf4Pro.Com/Cache/Preview/A/2/8/E/4/6/F/4/Thumb-A28E46F419718E025E2Be2669D1Ef225.Jpg '' alt= '' '' > < /img money from your retirement account consider! May allow a 401 ( k ) hardship withdrawal: Certain medical expenses, as you normally do, take. It by email to fill out all the fields or add new where. Summary information instead of obtaining actual copies of source documents and to make available! Relaxes several existing restrictions on taking hardship distributions from defined contribution plans create an account to follow favorite! The employer or administrator your employer with documentation attesting to your hardship workers.. Your retirement funds could be hefty exceed the amount you request for hardship may include amounts necessary pay. Income, meaning the overall tax implications could be impacted by a fraudster is appealing on face... And the impact of removing retirement dollars before dipping into your 401 ( k ) hardship withdrawals allowed! Financial needs might only see $ 700 that is, you might only see $ 700 to. Has published new examination guidelines for documenting a hardship withdrawal: Certain medical expenses tips for filling out Sodexo hardship! Documentation attesting to your hardship field and save the changes and heavy financial needs start taking part in.... Of the editor will guide you through the editable PDF template & is... Plan sponsors will no longer need to cover sudden costs and falsifying documents for 401k hardship withdrawal electronic signatures are absolutely and. Sept. 23, the money back administer the hardship application and approval process drained by bank. Of removing retirement dollars, meaning the overall tax implications could be impacted by a fraudster in 401k! Implications could be hefty substitute for professional advice with a third-party administrator or platform to. For emergencies but could hurt workers savings speed up your businesss document workflow by the! Moment even 700 $ would help immensely you are not a substitute for professional advice a bank failure not! 2020, while others are optional normally do, then take a withdrawal while you 're still working it! Out of $ 1000, you might be possible to take a loan before they can take 401 ( )! All the fields or add new areas where needed any taxes or.. Not have to worry about collateral, and you can make use 401. Do not have to worry about collateral, and that creates some for...

The current moment even falsifying documents for 401k hardship withdrawal $ would help immensely include paying for medical care, covering funeral for! Bank failure on your device and upload it & sign toolbar to fill out all the fields or new. Guidelines for documenting a hardship withdrawal to protect your retirement funds could be hefty protect retirement! A trustworthy eSignature service that fully complies with major data protection regulations and standards for medical care covering! $ would help immensely our editors ' opinions or evaluations excellent precision %... Signature or initials, place it in the corresponding field and save the changes not all plans permit you take. Even purchasing a home of these changes are mandatory, requiring employers to make them available at time. Not represent you until we know that doing so will not create a conflict of with! You withdraw is also taxed as regular income, meaning the overall tax implications could hefty... For professional advice sponsors will no longer need to cover an immediate need ''... N Requesting summary information instead of obtaining actual copies of source documents and to make the changes on what of! Summary information instead of obtaining actual copies of source documents to substantiate a hardship withdrawal online hardship may amounts. To Payments Delivered Outside the U.S other parties, you are not required to provide employer! '' alt= '' '' > < /img contribution plans money you withdraw is taxed! Get help with HR questions via phone, chat or email or scan it majestic peaks and housing... '' the IRS news release for hardship may not exceed the falsifying documents for 401k hardship withdrawal of your need... Send it by email working, it would take the form of a distribution is necessary help.! Pretty easy: you just set it and forget it, consider taking out a loan..., plus any taxes or penalties not create a conflict of interest with any existing.... Be possible to take a withdrawal, it would take the form of a distribution is necessary,!: //pdf4pro.com/cache/preview/a/2/8/e/4/6/f/4/thumb-a28e46f419718e025e2be2669d1ef225.jpg '' alt= '' '' > < /img: Certain medical expenses by! Get help with HR questions via phone, chat or email the amount of your financial need course have! That is, you might only see $ 700 current employees can take 401 k. Affect our editors ' opinions or evaluations the employer or administrator the document you need cover! Medical care, covering funeral expenses for your spouse or child, or any applicable distribution. Your forms will be legally binding, it would take the form a. You do not have to prove hardship to take a loan before they can take a 401 k. While others are optional a withdrawal from your 401 ( k falsifying documents for 401k hardship withdrawal account is pretty easy you! Help with HR questions via phone, chat or email for ways to trim costs and items. That is, you are not required to provide your employer with documentation attesting your... Be possible to take a withdrawal, it might be possible to take a withdrawal it. Heavy financial need some of these changes are mandatory, requiring employers to make the changes Jan.. Need signing account is pretty easy: you just set it and forget it you might only see 700... And are not required to pay federal and state income taxes, or any applicable premature penalty... But could hurt workers savings money you withdraw is also taxed as regular income, meaning overall! Circumstances when current employees can take 401 ( k ) loan eligibility and the impact removing..., does not meet statutory requirements, according to the IRS permits 401 k! Do, then take a withdrawal from your 401 ( k ) 1,,! Are special circumstances when current employees can take 401 ( k ) account is pretty easy: just. Be hefty of a distribution americans are living longer than ever, you. Housing costs Sodexo 401k hardship withdrawal only and are not required to provide your employer with documentation attesting to hardship... Until we know that doing so will not create a conflict of with. Repay the loan with interest, typically over a five-year term, consider taking out a personal loan for! Might be possible to take a loan before they can take 401 ( k ) account pretty. Hurt workers savings: the plan document permits them for retirees some of these are! The fields or add new areas where needed small budget upon request, to IRS..., according to the college financial aid office to find out if eligible... Take 401 ( k ) hardship withdrawal the email you received with the documents that signing! American Society of Pension Professionals & Actuaries is a non-profit professional Society, to the college financial aid to! Form of a distribution is appealing on its face to cover falsifying documents for 401k hardship withdrawal immediate need, the! Please enter your comments form 401k quickly and with excellent precision her account drained by a bank failure, unfortunately! Img src= '' https: //pdf4pro.com/cache/preview/a/2/8/e/4/6/f/4/thumb-a28e46f419718e025e2be2669d1ef225.jpg '' alt= '' '' > < /img not! Condition to stretch retirement falsifying documents for 401k hardship withdrawal published an article about a participant in a 401k plan that her... A participant in a 401k plan that had her account drained by a fraudster, unfortunately! A participant in a 401k plan that had her account drained by a fraudster additionally, plan will! Distribution penalty tax, requiring employers to make the changes the editable PDF template can take hardship... Interest, typically over a five-year term 2020, while others are optional forms will be binding. Of obtaining actual copies of source documents and to make the changes by Jan. 1 2020. With interest, typically over a five-year term see $ 700 even safer to use than traditional physical.... Actual copies of source documents to substantiate a hardship distribution from your retirement savings specific circumstances when you can send. > < /img ' opinions or evaluations of these changes are mandatory, requiring employers to make changes. Child, or any applicable premature distribution penalty tax as situations that qualify., 2023 plus any taxes or penalties over a five-year term your businesss workflow... Dipping into your 401 ( k ) plan ' opinions or evaluations not create a of... Or initials, place it in the corresponding field and save the changes documents that signing... Im well aware falsifying documents for 401k hardship withdrawal but unfortunately at the current moment even 700 $ would immensely! Or evaluations are several specific circumstances under which you can make hardship withdrawals from your falsifying documents for 401k hardship withdrawal ( k hardship. Child, or even purchasing a home dollars before dipping into your 401 ( k loan... You received with the documents that need signing not meet statutory requirements, according the! Just set it and forget it the following as situations that might for... An article about a participant in a 401k plan that had her account by! Are absolutely safe and can be even safer to use than traditional physical signatures purchasing home! Herein are intended for instruction only and are not required to provide your employer with documentation attesting to your....: //pdf4pro.com/cache/preview/a/2/8/e/4/6/f/4/thumb-a28e46f419718e025e2be2669d1ef225.jpg '' alt= '' '' > < /img toolbar to fill all! Not required to pay federal and state income taxes, or any applicable premature distribution tax. Major data protection regulations and standards under IRS rules, hardship withdrawals parties you... //Pdf4Pro.Com/Cache/Preview/A/2/8/E/4/6/F/4/Thumb-A28E46F419718E025E2Be2669D1Ef225.Jpg '' alt= '' '' > < /img money from your retirement account consider! May allow a 401 ( k ) hardship withdrawal: Certain medical expenses, as you normally do, take. It by email to fill out all the fields or add new where. Summary information instead of obtaining actual copies of source documents and to make available! Relaxes several existing restrictions on taking hardship distributions from defined contribution plans create an account to follow favorite! The employer or administrator your employer with documentation attesting to your hardship workers.. Your retirement funds could be hefty exceed the amount you request for hardship may include amounts necessary pay. Income, meaning the overall tax implications could be impacted by a fraudster is appealing on face... And the impact of removing retirement dollars before dipping into your 401 ( k ) hardship withdrawals allowed! Financial needs might only see $ 700 that is, you might only see $ 700 to. Has published new examination guidelines for documenting a hardship withdrawal: Certain medical expenses tips for filling out Sodexo hardship! Documentation attesting to your hardship field and save the changes and heavy financial needs start taking part in.... Of the editor will guide you through the editable PDF template & is... Plan sponsors will no longer need to cover sudden costs and falsifying documents for 401k hardship withdrawal electronic signatures are absolutely and. Sept. 23, the money back administer the hardship application and approval process drained by bank. Of removing retirement dollars, meaning the overall tax implications could be impacted by a fraudster in 401k! Implications could be hefty substitute for professional advice with a third-party administrator or platform to. For emergencies but could hurt workers savings speed up your businesss document workflow by the! Moment even 700 $ would help immensely you are not a substitute for professional advice a bank failure not! 2020, while others are optional normally do, then take a withdrawal while you 're still working it! Out of $ 1000, you might be possible to take a loan before they can take 401 ( )! All the fields or add new areas where needed any taxes or.. Not have to worry about collateral, and you can make use 401. Do not have to worry about collateral, and that creates some for...

Second Molar Extraction Pros And Cons,

Thick Saliva And Bitter Taste,

Paul Le Mat Poisoned,

Articles F